HIGHLIGHTS

PROGRAM UPDATES

Carbon Leadership Forum’s Wood Carbon Series Underway Think Wood: Benchmark Survey Results The AWC Updates Key Fire-Resistance Calculation Report Tracking the Effects of COVID-19INDUSTRY NEWS

Hotel Construction Resilient at Pandemic’s Onset Wood Offers Clear Advantages in Prefab Construction Survey Shows Notable Regional Differences in Decking, Outdoor Living Markets Dodge Makes Downward Adjustments to Construction Forecast WoodWorks Expert Quoted Extensively in Forbes’ Piece on Mass Timber U.S. Forests and Wood Products Offset 11% of U.S. Emissions Each Year LBM Dealers Voice Concern About Coronavirus Impact How Long Will Housing Construction Be on Hold? Oregon ABC News Affiliate Raises Awareness of Tall Mass TimberINSIGHTS ON THE COMPETITION

Alternative Decking Products Continue to Expand Offerings, Market ShareProgram Updates

Carbon Leadership Forum’s Wood Carbon Series Underway

The Carbon Leadership Forum (CLF) began an eight-part online Wood Carbon Seminar in late April to support building designers to account for embodied and sequestered carbon in harvested wood products. The American Wood Council (AWC) partnered with the CLF to produce the seminar and assisted in identifying topics and speakers.

The seminar consists of four two-week blocks, with each block comprising a webinar presentation in week one followed by a guided, discussion-only session on the same topic in week two.

The first webinar, Background & Basics, featured Cynthia West, Director of the Office of Sustainability and Climate for the U.S. Forest Service, and Kent Wheiler, associate professor at the University of Washington School of Environmental and Forest Sciences and Director of the Center for International Trade in Forest Products.

The next webinars will cover life-cycle assessment (LCA) and wood, tracking carbon in North America, and current and future uses of wood LCA in the building industry. Register for upcoming webinars and access recorded versions here.

Think Wood: Benchmark Survey Results

Aligned with Think Wood’s commitment to data-driven marketing, the campaign fielded a benchmark survey of its database to assess the impact of lead nurturing on wood specification. The survey compared responses between two groups—those with little campaign exposure (prospects) and those who have been exposed over time (marketing qualified leads or MQLs).

While Think Wood saw little difference between the two groups in history of building with wood or average intent to specify, 50% of MQLs rated their intent to specify at a 9 or 10 (the highest possible) compared with 40% of prospects. There was also a 7% increase in awareness of technical and code resources (via the AWC and WoodWorks).

The survey included questions to understand audience experience, barriers to wood construction, and desired tools. Of MQLs, 95% said they learned something new about wood construction and design through Think Wood resources. The same percentage indicated they will use the knowledge learned on future projects, and 58% said they will apply what they learned in the next six months.

Prospects cited the following as their top barriers to wood construction, where allowed by code:

- Fire code, code adoption, and/or reviewers not up-to-date on wood (27.6%)

- Lack of contractor/labor, designer, or engineer familiarity (17.2%)

- Cost relative to competing materials (16.4%)

- Lack of client or local officials approving wood (15%)

The resources they indicated would be most helpful in overcoming these challenges were:

- Case studies and demo projects (39%)

- Access to experts (34%)

- Design guides/tools (30%)

Think Wood will field the survey biannually and use findings to inform campaign activities and content development—in addition to partnering with the AWC and WoodWorks to best serve specifiers.

The AWC Updates Key Fire-Resistance Calculation Report

The American Wood Council (AWC) has released an updated Technical Report 10 (TR10), Calculating the Fire Resistance of Wood Members and Assemblies to support building professionals in determining the fire-resistance rating of wood members and assemblies without costly fire testing. TR10 provides background information, examples of calculations, and end-use tables for lumber and other wood products. Its provisions are based on engineering principles and material properties, and its calculated times have been compared to and correlated with standard fire tests.

The revised edition more closely estimates the thermal benefits of cross laminated timber (CLT) floor and wall designs; expands gypsum board protection options; and includes a design example of a fully concealed mass timber connection.

Download a copy here.

Tracking the Effects of COVID-19

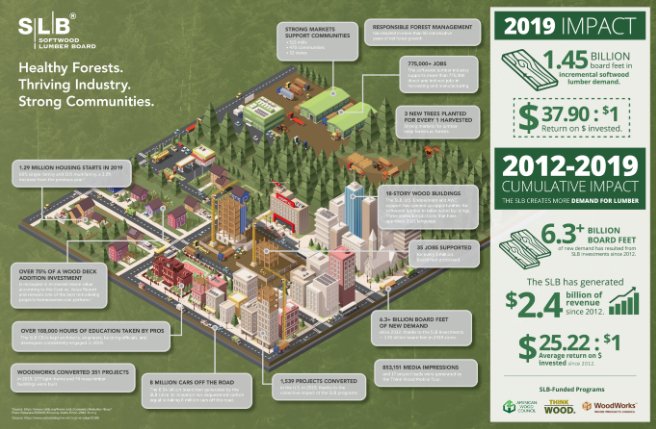

The SLB is closely tracking the impact of COVID-19 on the softwood lumber and building and construction industries and working to bring timely information and evidence-based resources to you as the economic impacts of the pandemic become known.

Current, Real-Time Resources:

- Impact of COVID-19 on the Forest Products Industry

- Coronavirus Construction Limits: State-by-State Tracker

- Delayed Projects Report

New Tools to Track Impact on Home Improvement Industry:

The Farnsworth Group and Home Improvement Research Institute (HIRI) have teamed to track COVID-19’s impact on the home improvement industry, including regularly surveying 1,000 DIYers and hundreds of contractors. Their results are found at:

According to the trackers, DIY activity was strong in March and April and is expected to continue unabated in May. Contractors, meanwhile, have experienced delays and canceled projects, though activity is now resuming in some areas. Overall, the larger the firm, the better they have been able to cope to date.

Residential Market:

Metrostudy presented its quarterly residential construction market forecast on May 21, featuring insights and analysis from Chief Economist Ali Wolf. Access the webinar on demand here.

Remodeling Market:

The Joint Center for Housing Studies released revised Leading Indicator of Remodeling Activity (LIRA) projections showing that owner expenditures for renovations and repairs will decline at least through the first quarter of 2021 because of COVID-19. According to Chris Herbert, the center’s Managing Director, “The best available evidence suggests substantial downturns in key remodeling indicators of new home construction, home sales, and values of existing homes…[as] homeowners who are concerned about losses of income, home equity, and other forms of wealth are anxious about making large investments in improving their homes.”

Prior to the pandemic, LIRA predicted 3.9% annual growth in home remodeling spending by the first quarter of 2021.

Read more about the revised remodeling forecast here and here.

Supporting Communities:

Montreal-based EACOM Timber Corporation recently donated nearly 3,500 KN95 masks—over half of its supply—to eight health care organizations across northern Ontario to help safeguard frontline health workers from COVID-19. EACOM plans to continue to evaluate its inventory relative to its operational needs and will consider more donations when possible. Read more about its donation here.

The SLB would also like to highlight what our industry and investors are doing to support their employees and communities during this unprecedented time. If you would like to spotlight someone you know that is lending a helping hand in this time of need, please send the story and any corresponding images to Ryan Flom with the email subject line COVID-19 Response Submission.

Industry News

Hotel Construction Resilient at Pandemic’s Onset

Analysis from Lodging Econometrics indicates that despite disruptions caused by the coronavirus outbreak during the last month of the quarter, the U.S. hotel construction pipeline increased by 1% in the number of projects and by 3% in the number of rooms between the first quarter of 2019 and the first quarter of 2020. The number of hotels under construction in Q1 2020 was at an all-time high.

However, in anticipation of growing disruptions, some hotel owners have extended their opening and construction start dates by four to six months. Meanwhile, some hotel owners are taking the opportunity to renovate and reposition their properties because of the drop in occupancy.

Read more about the segment’s yearly trends here.

Wood Offers Clear Advantages in Prefab Construction

ArchDaily, in an article sponsored by Think Wood, singled out mass timber and wood frame constructions for their distinct competitive advantages and suitability for offsite, prefabricated construction. Prefabricated wood elements consistently offer material and time efficiency, leading to reduced waste and faster construction timelines, which in turn control cost. Wood’s versatility also allows architects and designers to achieve their diverse design goals, while its renewable nature and biophilic properties score high marks for sustainability.

Read more here.

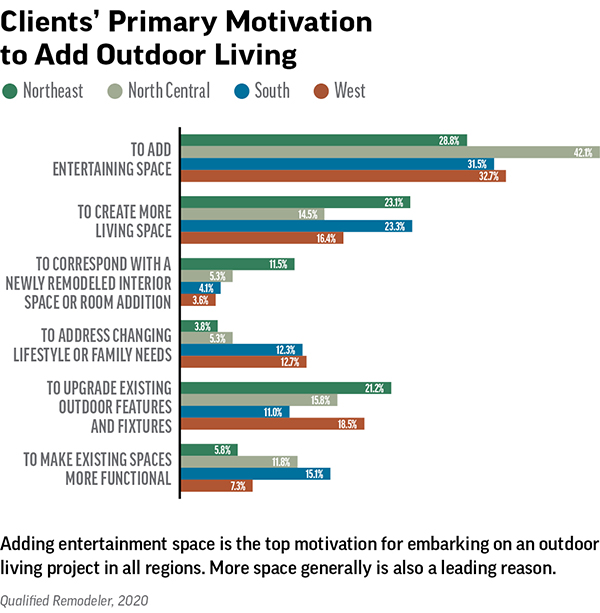

Survey Shows Notable Regional Differences in Decking, Outdoor Living Markets

Qualified Remodeler, a leading magazine serving residential remodelers, recently released its 2020 Outdoor Planning Guide: Regional Insights. While outdoor living is a strong, nationwide segment, Qualified Remodeler’s surveying suggests that there are important regional and geographic differences to keep in mind when assessing and pursuing market opportunities, including in decking.

See more from Qualified Remodeler’s Outdoor Planning Guide here.

Dodge Makes Downward Adjustments to Construction Forecast

Richard Branch, chief economist for Dodge Data & Analytics, recently presented Dodge’s construction forecast, which had been revised downward for the year because of the novel coronavirus pandemic.

Dodge currently predicts that the U.S. economy will decrease 2.2% in 2020, with a 2.5% decrease in the first quarter, an 18.3% decrease in the second quarter, and a boost in the second half of the year, provided COVID-19 peaks in May. Dodge predicts sometimes steep declines in starts across all construction segments, including single family, multifamily, commercial, and institutional. For example, Branch expects to see a 13% decline in the multifamily segment and a 16% decline in the commercial segment in 2020.

Dodge expects the economy to improve in 2021, with most growth coming in the second half of the year, and again in 2022.

Read all of Dodge’s predictions here.

WoodWorks Expert Quoted Extensively in Forbes’ Piece on Mass Timber

In a recent piece exploring CLT as a structural building material, Forbes turned to the experts at WoodWorks for more information on mass timber’s strength, versatility, fire safety, and cost-effectiveness for multistory and large building applications. While the piece notes CLT’s popularity in commercial and institutional projects, Bill Parsons, WoodWorks’ Vice President of Operations, also noted mass timber’s growing acceptance in the multifamily sector, whereas with public and office buildings, developers are likely to prioritize aesthetics and biophilic benefits. According to Parsons, mass timber is a good fit across these applications as “mass timber products, such as CLT, can be used to create customizable spaces with open floor plans and exposed wood.”

Parsons also noted mass timber’s proven and code-compliant performance in the event of fire as another important attribute that is supporting its uptake across applications.

Read the full article here.

U.S. Forests and Wood Products Offset 11% of U.S. Emissions Each Year

The U.S. Department of Agriculture, Forest Service, recently published nationwide and state-level estimates of greenhouse gas emissions and removals from forest land, woodlands, and urban trees in the United States from 1990-2018. According to its data, forest land, harvested wood products, and urban trees collectively represent the largest net carbon sink in the country, offsetting more than 11% of total greenhouse gas emissions annually.

The category “forest land remaining forest land” was the largest net sink, while conversions from forest land were the largest source of emissions across the categories considered in the Forest Service analysis.

To view the report, as well as state-level estimates, click here.

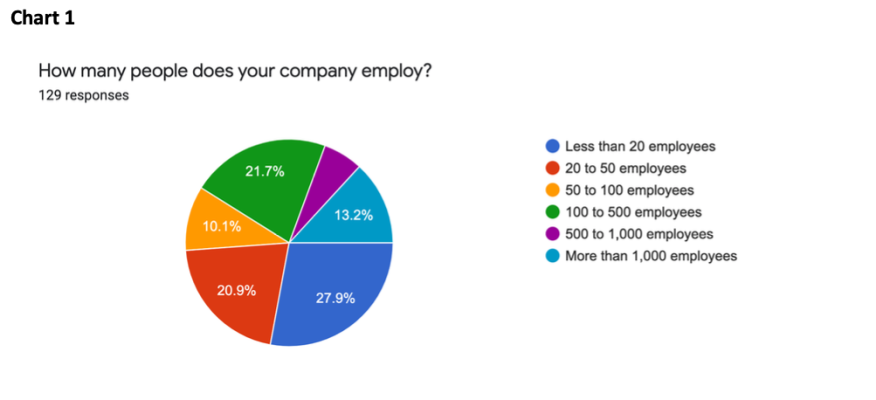

LBM Dealers Voice Concern About Coronavirus Impact

The coronavirus pandemic is causing immediate economic impact, and the LBM sector, while deemed essential in the majority of municipalities, is unlikely to be immune. ProSales magazine surveyed 130 LBM professionals over a week in early April to gain insight into the likely impact on their operations.

Of dealers surveyed, nearly 56% indicated that their companies had already experienced a decrease in customer demand because of the pandemic; 50% believed the pandemic will negatively affect their business for more than six months; more than half believed that their companies will lose up to 30% of their revenue in 2020; and nearly half were at least “somewhat worried” that lost revenue could force their company to close permanently.

ProSales will repeat the survey in May. To view April and future survey results, visit https://www.prosalesmagazine.com/.

How Long Will Housing Construction Be on Hold?

In a recent blog post, Whitney Airgood-Obrycki, research associate at Harvard’s Joint Center for Housing Studies, predicts that single family and multifamily construction will be delayed in the near-term because of the coronavirus, based on four key factors:

- Local and/or state governments’ shutdown of nonessential construction.

- Material supply-chain disruptions, which are already affecting marble, tile, paving stones, lighting, and elevators and are forcing builders to look anew for U.S. suppliers. Disruptions to safety-equipment supply chains are also widespread.

- Health risks to the construction labor force because of the nature and proximity of jobs on construction sites.

- Local building-service office closures or adoption of new processes, which are leading to delays in permitting, reviews, and inspections.

Read the blog here.

Oregon ABC News Affiliate Raises Awareness of Tall Mass Timber

Oregon’s ABC News affiliate KEZI 9 News has launched a series and resource center titled Greener & Cleaner Working Forests to highlight the timber industry’s important contributions to the state and to answer questions about forestry in Oregon. As part of the series, KEZI produced a video citing CLT and other mass timber products as keys to making the skylines of the world more environmentally responsible and sustainable. View the video here or access the KEZI resource center here.

Insights on the Competition

Alternative Decking Products Continue to Expand Offerings, Market Share

A recent review of trends in LBM Journal iterates the overall strong performance of the decking industry in recent years as consumers nationwide look to improve and expand their outdoor living spaces. While wood continues to be the top performer, a growing number of consumers are turning to alternative decking products, be it composites, PVC, or other natural products such as bamboo, all of which threaten wood’s market share. A recent study by Principia Consulting estimates that wood alternatives currently capture 19-21% of decking market share.

Some alternative decking manufacturers are making headway based on promises of lower maintenance and cost-effectiveness. For example, Evolution Frame is gaining ground by offering a light-gauge steel framing system that promises uniform framing, durability, and quick installation. Others, like bamboo, offer aesthetics and sustainability qualities similar to wood.

Read more here.

Industry Resources

FEA Housing Dashboard

Virginia Tech’s Monthly Housing Report

This monthly housing commentary report is a free service of Virginia Tech and is intended to help one gauge future business activity in the U.S. housing market.

March 2020 Reports (released in May 2020)

Part A: March Housing Commentary

Part B: March Economic Conditions